Lv kazino

Cardano currently holds a market capitalization of $24.7 billion but has yet to make any significant moves in this cycle. However, there is growing speculation that Coinbase is becoming increasingly favorable toward Cardano, which could lead to a major launch on the exchange https://online-kazino-lv.org/.

Sui is positioned as a highly capable token with significant potential for recovery. It brings the benefits of Web3 with the ease of Web2, making it an appealing option for investors looking for innovative blockchain solutions. Since its inception in 2024, $SUI’s market capitalization has grown from $2.4 billion to $15 billion.

Such a development has the potential to drive a substantial price surge for the asset. While $ADA has remained relatively quiet in terms of major advancements, a strategic listing or increased support from major platforms like Coinbase could be the catalyst for a strong upward movement in its valuation.

Cryptocurrency market analysis march 2025

To address scalability issues, Layer-2 solutions like Polygon (MATIC) and the Lightning Network are gaining traction. These technologies enable faster and more cost-effective transactions, enhancing the practicality of cryptocurrencies for everyday use.

This clarification may lead to a surge in memecoin projects, as creators feel more secure operating within a defined legal framework. However, investors should remain vigilant, as the lack of regulatory oversight could result in increased volatility and potential risks.

A notable market event unfolded this morning as AI-related tokens experienced sudden surges in trading volume. SingularityNET (AGIX) and Fetch.ai (FET) saw significant increases following Grok’s announcement of their new AI model, Grok-3, which aims to revolutionize data analysis in the crypto space.

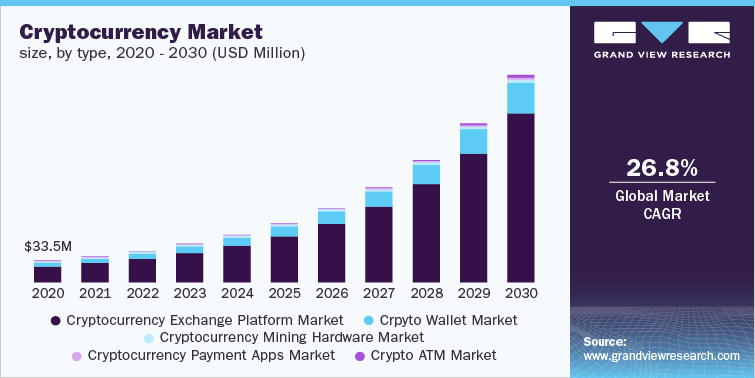

Institutional participation is set to deepen, with banks exploring proprietary stablecoins and corporations incorporating Bitcoin and Ethereum into their treasuries. The expansion of ETFs globally could further enhance liquidity and legitimacy for the crypto market.

DeFi protocols are expected to lock in over $250 billion by 2025, with platforms like Aave and Compound leading the charge. These protocols offer decentralized alternatives to traditional financial systems, attracting both retail and institutional interest.

Cryptocurrency market analysis february 2025

While Bitcoin reached new all-time highs this January, altcoins remained relatively stagnant. Will February finally bring an altcoin season? With over 20 countries and regions, including major crypto markets like China, Japan, and South Korea, entering the Lunar New Year holiday period, could we see significant market movements?

In 2025, 24% of respondents in the UK said they were invested in cryptocurrency, up from 18% in 2024. It was the biggest year-over-year jump of any of the nations surveyed. It was also the second highest ownership rate recorded, trailing only Singapore (28%).

The latest crypto financial calendar has just been released, providing comprehensive coverage of key events both within and outside the crypto sphere, along with detailed analysis of their potential market impact and underlying dynamics.

The crucial Fibonacci level of $0.00012 will be significant for SHIB bullish momentum. Continued development and community support will be key drivers, alongside potential integrations and partnerships.

Macroeconomic Factors: Broader economic trends, such as potential new tariffs, inflation, and interest rate policies, can also impact the crypto market. Concerns about tariff policies and cautious monetary policy could slow capital inflows into speculative assets, including cryptocurrencies.

Throughout 2025, SUI is predicted to trade between $2.44 and $8.80 based on SUI upward revised price targets (Oct 12th). Key drivers: institutional adoption and technological advancements. If market conditions remain favorable, SUI could experience significant growth.